Spotlight

The crucial role of steel in India’s engineering sector

It is well-established that steel is an essential element for growth. A well-coordinated effort between the government, the steel industry, and user industries is imperative to build a robust and competitive engineering sector in India

SINCE the 18th century Industrial Revolution, steel has played a vital role in growth of economies around the world. Steel has uses in various sectors – infrastructure, automobile, manufacturing, construction, etc. Steel is also an important factor driving India’s GDP growth. India’s success in the steel industry comes from having extensive reserves of iron ore coupled with cheap labour. This has not only given a fillip to the steel industry but also helped India diversify its manufacturing sector.

STEEL INDUSTRY – IMPORTANT FACTS AND FIGURES

Steel production in India has been growing at a fast pace. As of December 2022, India was the world’s second-largest producer of crude steel. In FY22, the production of crude steel and finished steel stood at 133.596 MT and 120.01 MT, EEPC INDIA SEPTEMBER 2023 l INDIAN ENGINEERING EXPORTS l 7 respectively. In April-November 2022, the production of crude steel and finished steel stood at 81.96 MT and 78.09 MT respectively. The growth in the Indian steel sector has been driven by the domestic availability of raw materials such as iron ore and cost-effective abour. Consequently, the steel sector has been a major contributor to India’s manufacturing output.

Trends in import and export of steel

Between April 2022-January 2023, exports and imports of finished steel stood at 5.33 MT and 5.0 MT, respectively. In FY22, India exported 11.14 MT of finished steel. In December 2022 exports of steel stood at 4.42 lakh tonne

IMPORTANCE OF STEEL IN INDIA’S ENGINEERING SECTOR

Steel is a major input for India’s engineering sector. For most of the subsectors, steel constitutes around 60 percent of the cost of production. Therefore, availability of steel at affordable prices is crucial for sustained growth and competitiveness. The engineering sector, encompassing diverse industries like automotive, construction, machinery, and steel articles, heavily relies on raw materials, with steel being a major input. However, the industry has faced significant challenges, particularly the MSMEs, due to the global pandemic and the subsequent surge in steel prices.

Steel’s prevalence in engineering sector

Steel finds extensive use in various sub-segments of the engineering sector, making it a critical component for many industries:

As per the National Steel Policy, the steel industry has significant potential for growth. Around 43 percent of the steel consumption is by the engineering and fabrication sector (Table2). The New Steel Policy seeks to increase per capita steel consumption to the level of 160 kg by 2030 from the existing level of around 60 kg. The policy seeks to increase consumption of steel in major segments such as infrastructure, automobiles, and housing.

Causes of increasing steel prices

The steel industry is currently grappling with several factors that contribute to the rising prices of steel. Foremost among these challenges are the issue of domestic availability and the soaring costs of essential raw materials, such as iron ore, pig iron, and coking coal. Additionally, the global impact of rising crude oil prices, particularly amidst the ongoing Ukraine-Russia conflict, further exacerbates the situation by making raw materials more expensive for steel production. The combined effect of these factors has led to a significant increase in steel prices in recent times

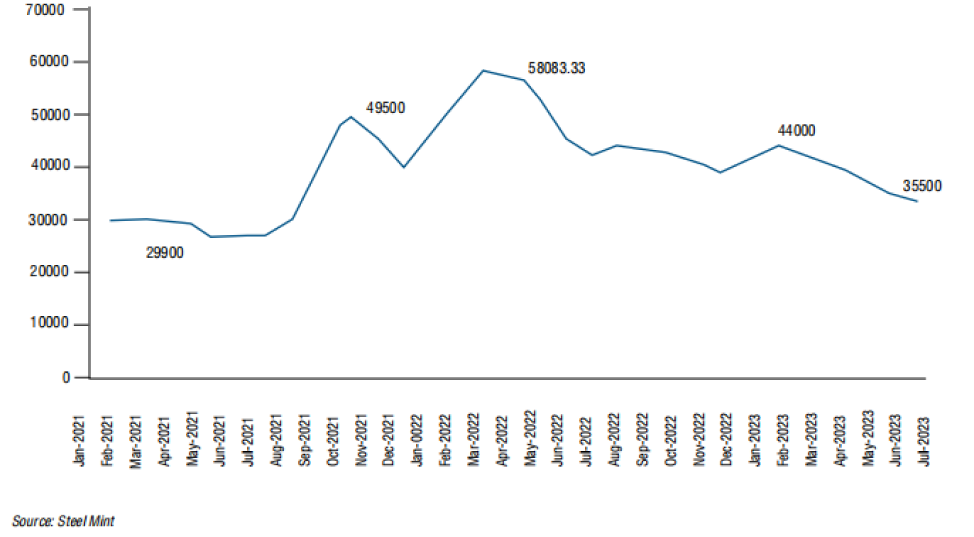

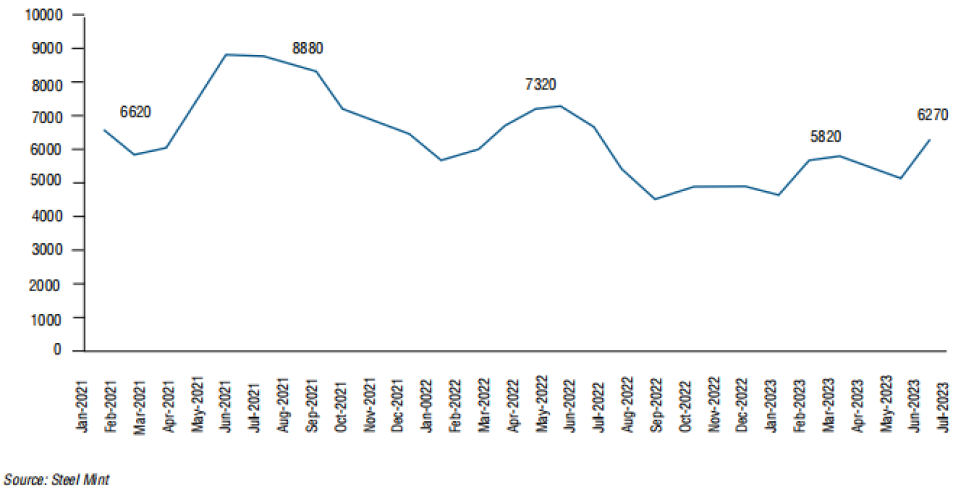

Steel production heavily relies on key raw materials like iron ore, coal, limestone, and recycled steel. Unfortunately, the prices of these critical resources are witnessing upward trends, adding to the burden on the steel industry. For instance, coking coal prices have surged from Rs38,500 per tonne in December 2022 to Rs44,000 per tonne in February 2023 (Source: Steel Mint). Similarly, iron ore prices, particularly NMDC iron ore lumps, have seen a substantial rise, soaring from Rs5690 per tonne in December 2021 to Rs7320 per tonne in April 2022. The upward trajectory continued, with iron ore lumps (NMDC) prices climbing from $4680 per tonne in July 2022 to $6270 per tonne in July 2023 (Figure6). As a result, this price surge has also had a cascading effect on other materials like sponge iron and pig iron, leading to their prices surging as well.

The escalating steel prices can be attributed to a combination of factors, including the challenges of domestic availability, rising costs of crucial raw materials like iron ore and coking coal, and the global impact of increasing crude oil prices due to geopolitical tensions. These collective pressures on the steel industry have resulted in the current surge in steel prices, posing significant challenges for players in the sector and affecting various downstream industries that rely on steel as a primary input.

Impact on engineering industry

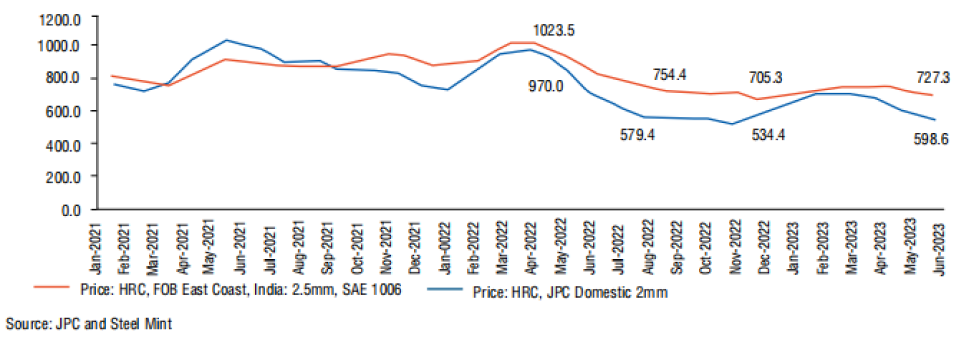

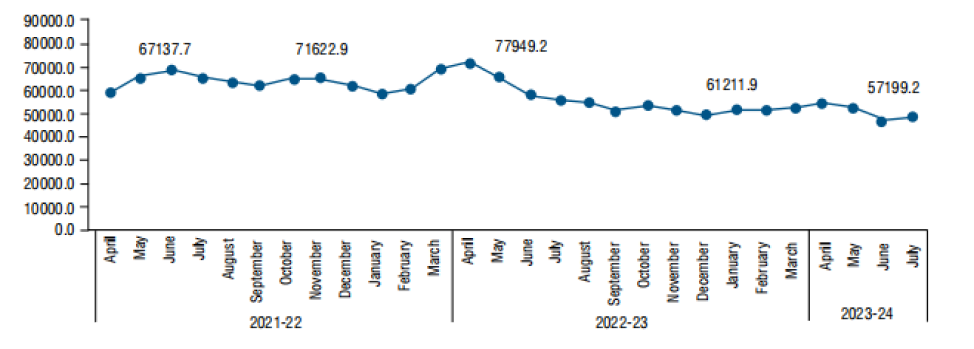

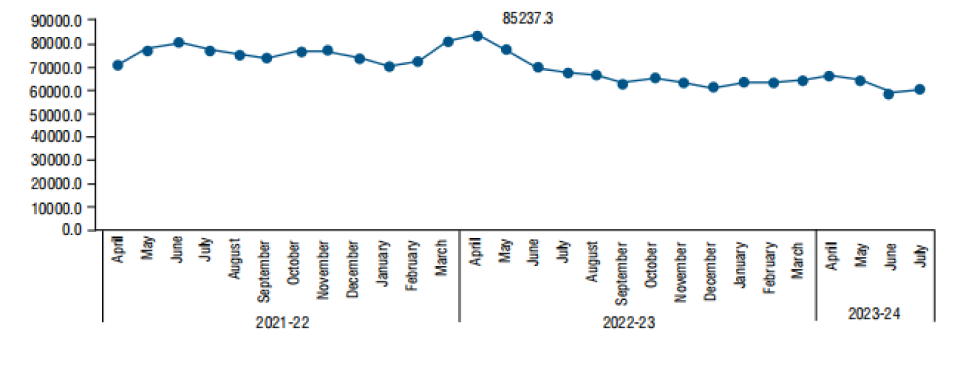

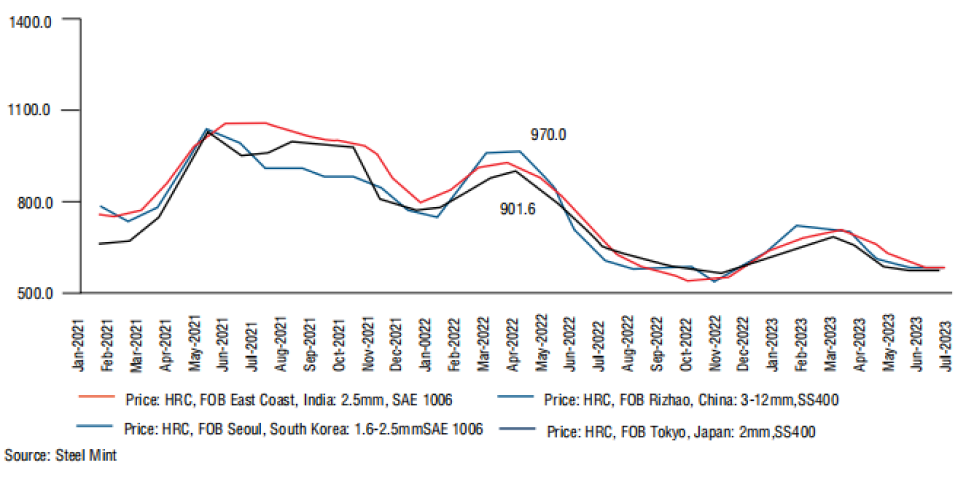

The engineering industry is currently facing challenges to maintain its competitiveness in the international market and fulfilling export obligations. To delve further into the matter, it is crucial to examine the utilisation of different categories of steel, such as hot rolled coils (HRC) and cold rolled coils (CRC), in various sub-segments of engineering. These segments primarily include automotive, railways, construction, pipes and tubes, among others. By analysing the prices of HRC and CRC, as illustrated in Figures7 and 8, we can understand the cost dynamics affecting the industry. This comprehensive evaluation will help in understanding the impact of raw material prices on the engineering sector’s over-all performance and export capabilities.

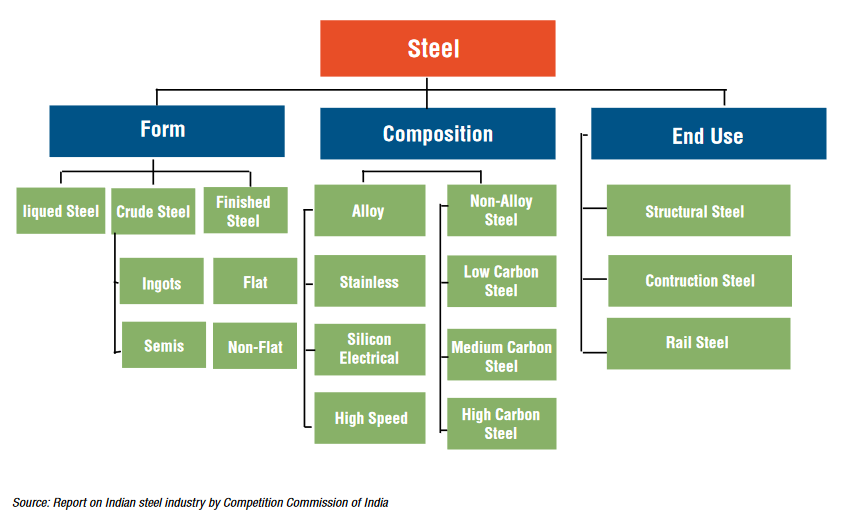

Figure1: Structure of steel sector

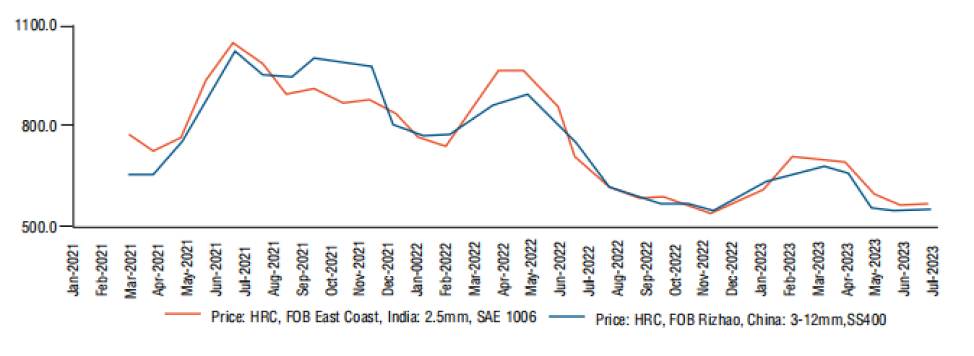

International steel price trend

Taking a global perspective, it is evident that since February 2022, the price trend of India’s fob HRC products are on a higher side compared to China fob HRC prices. While India’s export fob price of HRC is almost at par with Japan and Korea, the international price gap between India and China varies within the range of 0 to 85. The international price trend of other countries including Japan and South Korea have also been compared in Figures9 and 10.

Domestic and export prices of HRC in India

While India’s export price is being made competitive globally, the domestic price is higher than export fob price. It has been observed that domestic producers prefer selling in the domestic market due to higher realisation. The difference in export and domestic prices for India has been in the range of $100-170 per tonne focused during November 2021 to June 2023. (Figure11).

Government initiatives

Due to the hike in the price of steel, the Union Ministry of Commerce and Industry, along with ISA formulated a policy on ‘Steel at Export Parity Price’ via Office Memorandum Ministry of Steel dated 24.06.2020. Under this scheme domestic steel producers would provide steel to the user industry (availed by only the MSME members of EEPC India) at an export parity price. These sales will be considered as deemed exports and the steel producer can avail duty drawback on steel supplied through their premises, service centres, distributors, dealers, or stockyards. The Steel at Export Parity Price scheme was made applicable on four product categories – HRC, CRC, wire rods and alloy bars. As per the notification, only six primary steel producers are included in the scheme.

EEPC India welcomed the Steel at Export Parity Price scheme. As per members’ feedback, it has been suggested that the steel companies who supply steel at the export parity price should be given all the benefits under the scheme as they get for physical exports to make the scheme more active and useful for the user industry.

Furthermore, it was suggested that the DGFT should provide the export parity price based on DGCI&S fob data for all the four products (HRC/CRC/wire rods/bars) at present. In addition, all major steel producers should be included in the scheme as currently only six primary steel producers are under it. It was also suggested that apart from the four products mentioned here, other steel products like billets, which are used by the MSME sector, should be covered under the export parity scheme.

Recommendations

- Establishment of an independent steel regulator: To address the disparities in pricing between domestic and export markets, it is crucial to establish an independent steel regulator. The body would ensure domestic price parity with export prices and protect interests of steel user industries as well. This will also help in resolving distortions in pricing (export vs domestic), which may provide undue benefits to one segment of the industry at the cost of another.

- Encouraging specialised steel production: Overall, India has limited presence in tool steel, super duplex, super austenitic, and high alloyed varieties of stainless steel for stringent end-use applications. For certain steel categories (or components), which have limited production in India, reduction of import duties may be considered till the time those are produced in India cost effectively.

- Addressing cost-related challenges: Steel is an important material in the engineering sector. High logistics cost, finance cost, power cost, cess, royalty is making India’s steel industry commercially non-competitive. In order to strengthen the steel industry, the government should provide benefits to the industry and simultaneously the user industry needs to be protected. The government should maintain a balanced approach to protect the interest of the user industry as well as to support the steel industry

- Steel export parity price: Strengthening the policy of Steel at Export Parity Price is really important. This policy can help when steel prices go up, especially for industries that use steel. Some of the suggestions received from our members are as follows:

- The policy should be easier to understand and use, so everyone can benefit from it smoothly.

- The policy should include all the big steel producers, like Tata Metalliks, Vedanta, and Usha Martin.

- The range of products covered by the policy should grow too. This means things like billets, galvanised coils, and pig iron should also get included, making the policy even more helpful.

Table 1: Use of steel in various sub-segments of engineering exports |

||

|---|---|---|

| Industry segment |

|

|

| Engineering |

|

|

| Railways |

|

|

| Energy |

|

|

| Packaging and appliances |

|

|

| Packaging and appliances |

|

|

Source: EEPC India Analysis

To conclude

Creating a conducive ecosystem for both the steel industry and user industries is very important. Government intervention plays a crucial role in ensuring a balanced approach that enables the availability of affordable raw materials for the steel industry and related sectors. A thriving steel industry holds immense significance for any economy, and concerted efforts are required to bolster its competitiveness in the global market.

A competitive steel industry positively impacts the user engineering industry as well, leading to an overall enhancement of the engineering sector’s competitiveness. To achieve this, the government must remain focused on implementing measures that support the steel industry’s growth and global standing.

A critical aspect that demands government attention is the availability of specialised steel in the country. By fostering domestic production of specialised steel varieties, the government can reduce reliance on imports, address trade deficits, and empower user industries with access to critical raw materials.

The introduction of the Steel at Export Parity Price policy was a commendable step by the government. To ensure its success, greater emphasis is needed to streamline its operational implementation. Effective policy execution, along with continued support from the goverment, will significantly contribute to the steel industry’s success and, consequently, the success of the engineering sector.

Table2: Sectoral share in steel consumption (MT) |

||

|---|---|---|

| Sector | Projected demand in 2030-31 | |

| Infrastructure | 90 | |

| Construction | 45 | |

| Engineering and fabrication | 43 | |

| Automotive | 10 | |

| Railways | 5 | |

| Packaging | 6 | |

| Energy | 11 | |

| Shipbuilding | 3 | |

| Oil and gas pipelines | 4 | |

| Defence | 2 | |

| Others | 11 | |

| Total finished steel consumption | 230 | |

Source: National Steel Policy 2017

A well-coordinated effort between the government, the steel industry, and user industries is imperative to build a robust and competitive engineering sector. By prioritising the steel industry’s growth, ensuring affordable raw materials, and promoting specialised steel production, India can strengthen its position in the global engineering market.

Figure5: Price of met coke ex-Jajpur: 25-90 mm, blast furnace-grade (Rs/tonne)

Figure6: Price of iron ore lumps

Figure7: JPC prices of HR coils (Rs/tonne)

Figure8: JPC prices of CRC (Rs/tonne)

Figure9: Comparison of international prices of HRC fob in India and China

Figure10: Trends in international prices of HRC – India, China, Japan South Korea

Figure11: Domestic and export prices of HRC